- #Texas ag exemption land requirements manual

- #Texas ag exemption land requirements code

- #Texas ag exemption land requirements license

Owners of land qualified as 1-d-1 need not file again in later years unless the chief appraiser requests a new application. Owners of land qualified as 1-d must file a new application every year. If the last day for the performance of an act is a Saturday, Sunday or legal state or national holiday, the act is timely if performed on the next regular business day. These standards define the required level of use, and management practices. Also different from Ag exemptions, homestead. The agricultural usage of the land must meet the local degree of intensity standards.

They are a property tax break for homeowners living in their primary residence. Homestead exemptions in Texas on the other hand are easy to receive.

They are not easy to get and can be difficult to maintain. Only land that is primarily being used and has been used for at least five of the past seven years for agricultural purposes may qualify for an ag exemption in Texas. The deadline to apply for productivity appraisal is April 30. Ag exemptions are only for land that is primarily being used for agricultural purposes. Land under wildlife management must also meet acreage size requirements and special use qualifications. Texas law allows farmers and ranchers to use land for wildlife management and still receive the special appraisal, but the land must be qualified for agriculture use in the preceding year. Under 1-d appraisal, the rollback extends back for three years. These rollback taxes under 1-d-1 are based on the five tax years preceding the year of change. Penalties in the form of a rollback tax, or the difference between the taxes paid under productivity appraisal and the taxes that would have been paid if the land had been put on the tax roll at market value, will be imposed if qualified land is taken out of agriculture or timber production.Ī rollback tax occurs when a land owner switches the land’s use to non-agricultural. The land must also be the owner’s primary source of income. Under 1-d appraisal, the land must have been used for this purpose at least three years and the owner must be an individual versus a corporation, partnership, agency or organization. Most land owners apply for the 1-d-1 appraisal. 1-d-1 appraisal does not restrict ownership to individuals and does not require agriculture to be the owner’s primary business. Owners must also show that the land was used for this purpose at least five of the preceding seven years.

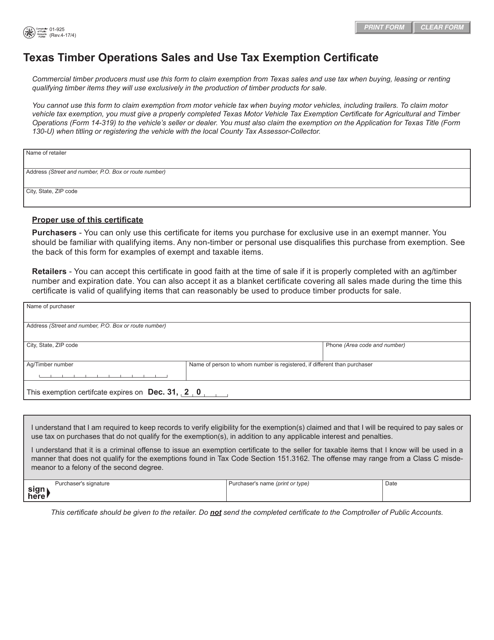

For 1-d-1 appraisal, property owners must use the land for agriculture or timber and the land’s use must meet the degree of intensity generally accepted in the area. The Texas Constitution authorizes two types of agricultural productivity appraisals, 1-d- 1 and 1-d, named after the section in which they were authorized. While forage availability may limit the stocking rate, there are some livestock operations that can succeed on small acreages. They may apply to the Henderson County Appraisal District for agricultural productivity appraisal and for a lower appraisal of their land based on how much they produce, versus what their land would sell for on the open market. New rural landowners are often interested in establishing livestock enterprises, even when their acreages are small. Applicant may also be required to complete an affidavit to qualify for an exemption under certain situations.įor a complete list of forms please visit the Texas State Comptroller’s website.Texas farmers and ranchers can be granted property tax relief on their land.

#Texas ag exemption land requirements license

*All homestead applications must be accompanied by a copy of applicant’s driver’s license or other information as required by the Texas Property Tax Code. Llano CAD Checklist for Organization Exemptions.Policy for Combining or Dividing Parcels.Real Property Inventory Valuation Procedures.The Appraisal District is located at 1611 Railroad St, Floresville, Texas 78114. to file for an EXEMPTION, or to report changes in OWNERSHIP or ADDRESS, please call the Appraisal District at (830) 393-3065.

#Texas ag exemption land requirements manual

#Texas ag exemption land requirements code

Real Property Inventory Property Tax Law Section 23.51 of the Texas Property Tax Code sets the minimum requirements for determining whether the land qualifies for agricultural appraisal.

What you will need to apply for a Homestead Exemption.Partial Property Tax Exemptions 2022 Certified Totals.50-312 Temporary Exemption Property Damaged by Disaster Application.Taxing Unit Disaster Exemption Presentation.Tax Payer Disaster Exemption Presentation.Citizen’s Comments and Public Participation Form.ARB Citizens Comments Public Participation Form.

0 kommentar(er)

0 kommentar(er)